Student Loans and other shark bites

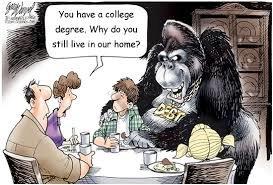

Almost all parents are caught up in the idea that advanced education is the way to go for their children. Alas, not all children do well in college and usually drop out.

Almost all parents are caught up in the idea that advanced education is the way to go for their children. Alas, not all children do well in college and usually drop out.

College today is Big Business and closely tied in with the banking industry, Student loans are a top priority to raise money and create debt that does manage the financial flow of the working class citizens. Once your child is in the hooks of a student loan and perhaps you too as a co-signer you will have decades of payments that bind you to a financial situation of a non-future.

Strong words? Talk to any student who has struggled to graduate, or talk to the parents who are holding two jobs to support the adult child in college. You might include talking to the dropouts who along with the graduates cannot find a job unless it is working in a “Bigger Burger” fast food at a 30-hour week.

The lure of easy money for a student is like a credit card. You “want”, you “need” a private apartment and a new car, better clothes, social activities, parties, and the list goes on. This is a different lifestyle than what we-the older generation, thought college would still be-nose to the grindstone. Let us see how it works: if you, the parents are poor, at least making, say $15,000.00, or less a year you are not obligated to sign co-pay. More income and you are doomed. You, the working parent, or parent with some assets are obligated to co-pay over a specified income level.

Most student loans average about $34,000.00 a year and some into the $70,000.00 and $150,000.00 range. The total USA debt for student loans is about 1.4 TRILLION dollars.

So your adult child, just out of rehab and dropped from school owes, and if he/she does not pay they come after you. Most fees with interest run for years and years.

Bankruptcy is not an option since the banksters have successfully petitioned congress and made it a law you have to pay. The only way to reduce your payments is to get a degree, say in education, and work in an impoverished neighborhood-usually gang related. Also there is a time limit if you pay enough and long enough the loan is cancelled. Best invest in a walker.

OK! You are rich and want to pay off your graduated spendthrift’s college debt. That is a gift and the Tax people will tax you with special rates. The graduated student also receives this debt and has to pay income tax on the payoff. The loan is taxed twice!

Then there is the old standby for education with pay and travel: The military service. (Not everybody goes to Afghanistan) Speaking of military service the military will pay for two years of non-obligated school funding, the next two years upon graduation is a commission in the respective service. Go Navy! Even if your child is a graduate of High School they can enlist, receive a trade such as in electronics, carpentry, truck driving, cooking, medical, and so on. Hard work brings advancement and often a commission. Think about retirement in twenty years. Think about free medical.

School planning for a career starts in the 9th grade and back to the nose to the grindstone. Hard work brings rewards. If your child was a goof-off and dropped out of high school he/she will need to see a school counselor. Perhaps he/she can make up a missing class, or two, but it takes counseling and back to hard work to catch up. One day at a time.

In this day and age you must have a skill set to make money, and make a comfortable career. Living under a bridge is not the way to go.

Good Luck!

God Bless the United States of America!

Old Timer

COPYRIGHT: Back2theLand.com All Rights Reserved. 7-10-2016